Highlights

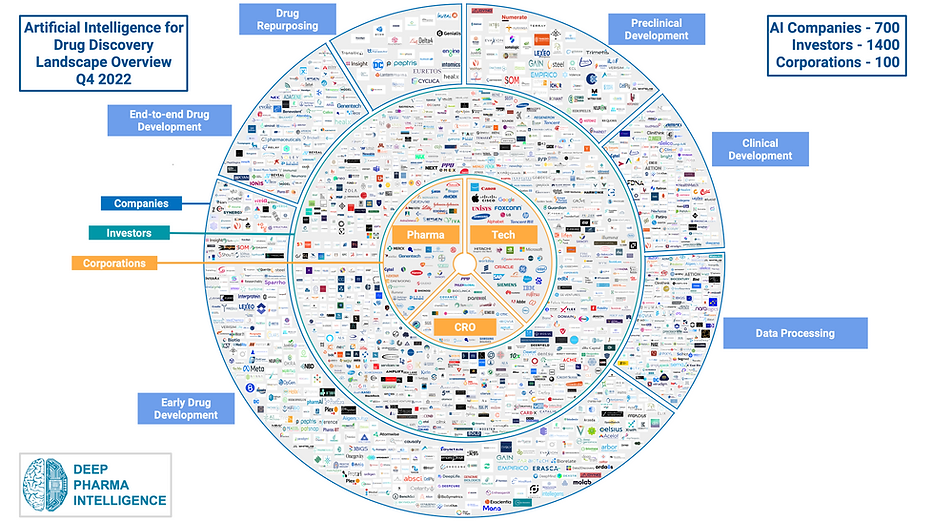

- 700 AI BioTech companies and 100 corporations that develop drugs

- 1400 investors in the area of pharmaceutical and healthcare application of artificial intelligence

- Database with Key Market players in the development of drugs using artificial intelligence in Asia

- Comprehensive overview of investments in drug development companies in Asia

- In-depth review of drug candidates developed in Asia

- Overview of artificial intelligence growth in Pharma during the last decade in Asian countries

Pharma Efficiency: Challenges

0 - Effect on body

I - Safety in humans

II - Effectiveness at treating diseases

III - Larger scale safety and effectiveness

IV - Long term safety

10 years + $2.6 bln = 1 new drug

It takes, on average, over 10 years to bring a new drug to market. As of 2014, according to the Tufts Center for the Study of Drug Development (CSDD), the cost of developing a new prescription drug that gains market approval is approximately $2.6 billion. This is a 145% increase, correcting for inflation, compared to the same report made in 2003.

The solution to this problem comes from three key strategies:

-

evolution of business models towards more collaboration and early pipeline diversification

-

implementation of AI as a universal shift towards data-centric drug discovery

-

discovery of new therapeutic modalities (biologics, therapies, etc.)

MindMap

MindMap: Focus on Asia

700 Artificial Intelligence Companies: Regional Distribution

Growth of AI Pharma Companies in Asia

The AI in Pharma market has developed steadily during the last 10 years in Asia. However, in the past 2 years, the market has been showing increased stagnation. The share of new companies from 2010 to 2020 is 77%. Growth in the historic period (from 2010 to 2022) resulted from the increase in investments in drug discovery, growth in research and development, a rise in public-private partnerships, increased healthcare expenditure, and rising pharmaceutical R&D expenditure.

Distribution of AI Pharma Private Companies in Asia by Total Funding

To learn more about leading companies, check our report.

Collaboration of Asian Companies with Big Pharma

Note: the central column (red) defines the pharmaceutical corporations, and side columns (blue) define AI companies that have collaborations with pharma companies from the central column.

The rising interest of leading pharma and contract research organizations towards Asian and HK AI-driven biotech startups is a major driver for the area to become more attractive for investors, since the industry is becoming well-suited for successful exit strategies in the future.

-

These companies demonstrate increasing commitment to probing the grounds in the AI space — by investing into internal programs, as well as partnering with external AI vendors to pilot programs in drug discovery and other research areas.

-

All deals were categorized as aiming to save costs and increase operational efficiency, due to the nature of the services provided.

Rise of AI in Drug Development: Disease Area

AI tools are increasingly being applied to drug discovery for different disease areas. One of the most popular areas is oncology. With the growing global burden of oncology diseases, discovery of cancer treatments is one of the most significant public health challenges of the 21st century.

Immunology is in second place, and 21% of companies use their AI technologies for find treatment for immunological diseases.

A lower percentage of programs aims to develop drugs in the field of neurology and inflammation as those treatments require the development of new targets. Other less popular areas are Cardiovascular, Gastro Intestinal, Orphan and Metabolic diseases.

Rise of AI in Drug Development in US, China and UK: Publications

On this graph you can see number of publications during the last 10 years for US, China and that have such terms as AI, Machine Learning, Artificial Intelligence or Deep Learning together with Pharmaceuticals, Drugs, Drug Development, Drug Discovery, Virtual Screening, Drug Design or Clinical trials.

Rise of AI in Drug Development in US, China and UK: Clinical Trials

In this table, you can see the number of registered clinical trials for the US, China, and UK that have such terms as AI, Machine Learning, Artificial Intelligence, or Deep Learning, and that have been registered with the specified phases of clinical trials. Most of them are related to diagnostic devices, and based on the number of registered clinical trials, China is the leader in promoting AI in Healthcare.

Since 2017, China has continuously introduced medical AI-related policies, and the regulation has been clear and implemented. During the last 2 years, the introduction of data security law and personal information protection law has put forward a higher requirement for medical AI enterprises to use patients' personal medical data.

To learn more about Rise of AI in Drug Development, check our report.

Drug Candidates Designed by AI: Asia

To learn more about drug development, check our report.

Notable R&D Use Cases of AI Application in Biopharma

Notable Case in HK: Insilico Medicine AI Platform

Combining genomics, big data analysis, and deep learning, the company has been using artificial intelligence algorithms to identify novel therapeutic targets and design novel drug candidates.

Notable case in Asia: Standigm AI Platform

Standigm’s optimized workflow AI system can generate multiple First-in-Class compounds within seven months.

To learn more about Pharma AI Industry development, check our report

World’s AI for Drug Development Landscape: Focus on Asia

The primary goal of this report is to give a complete picture of the industry environment in terms of AI usage in drug discovery, clinical research, and other elements of pharmaceutical research and development, with the focus on Asia. This overview highlights recent trends and insights in the form of helpful mind maps and infographics. It can help the reader understand what is going on in the sector and potentially predict what will happen next.